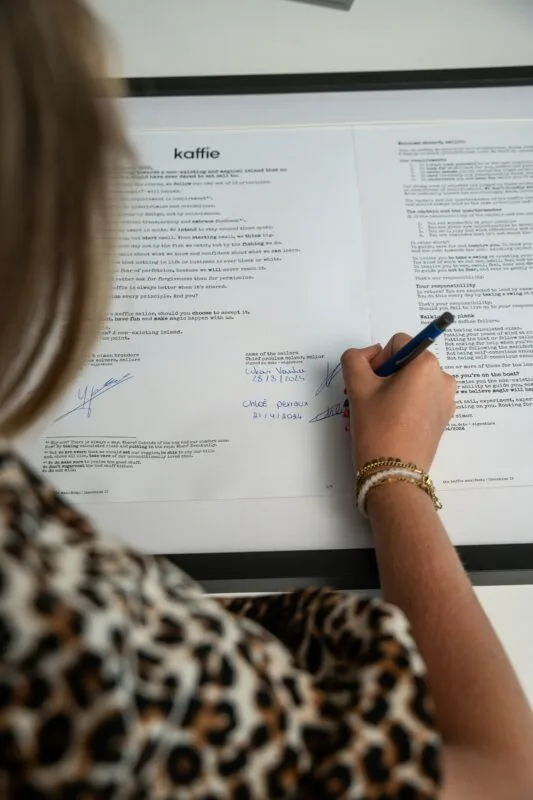

No matter what your responsibilities are as part of the executive team, the legal department, or in business development, knowing how to review an NDA (Non-Disclosure Agreement) is a routine but crucial task, especially when sensitive information is involved. These agreements are designed to protect your company’s information, but they can be complex and sometimes overwhelming to handle.

Reviewing an NDA means ensuring that all key terms are clear and that your company’s interests are protected. It’s about knowing what to look for and visualizing the implications of each clause. Even a small oversight may lead to unintended consequences down the road, so a thorough review is essential.

We’ll walk through the steps of conducting an NDA contract review in a straightforward way. You’ll find practical tips, a clear NDA review checklist, and some advice on how tools like AI NDA review software for contracts can help make the process faster, and at a fraction of the traditional contract review cost.

What you need to know about an NDA review

Non-Disclosure Agreements (NDAs) are fundamental legal tools used by businesses to protect sensitive information. They’re employed in a variety of situations, from initial negotiations and partnerships to full-scale business ventures. In other words, NDAs are designed to make sure confidential information exchanged between parties remains secure and isn’t disclosed to unauthorized third parties.

The significance of NDAs has grown in the startup ecosystem for protecting intellectual property (IP). Stephen Key wrote on Forbes that many entrepreneurs mistakenly believe that simply signing an NDA will fully protect their IP. However, as highlighted by experts in the field, it’s fundamental to understand when and how to use an NDA, and that additional precautions may be necessary to safeguard ideas.

Key components of a non-disclosure agreement

A typical NDA contract review checklist includes some of these components:

| Component | Description |

| Parties involved | The NDA should clearly identify the parties who are entering into the agreement. This typically includes the disclosing party (the one sharing the information) and the receiving party (the one receiving the information). |

| Definition of confidential information | Specifies what constitutes confidential information under the agreement. This definition of confidential information should be broad enough to cover all relevant details but specific enough to avoid ambiguity. |

| Obligations of the receiving party | Obligations outline what the receiving party is obligated to do with the confidential information, including restrictions, how it should be handled, access, and how long it needs to be kept confidential. |

| Exclusions from confidentiality | Not all information is considered confidential. This section details what is excluded from the agreement, such as information that’s already public or independently developed by the receiving party. |

| Term and termination | The non-disclosure agreement (NDA) should specify how long the obligations of confidentiality will last, whether it’s a fixed period or indefinite until the information is no longer deemed confidential. |

| Consequences of breach | Describes the legal remedies or repercussions available if the NDA is breached. This could include damages or injunctions, which are court orders that prevent further disclosure or use of confidential information. |

| Governing law and jurisdiction | Determines the jurisdiction and applicable law that’ll govern the interpretation and enforcement of the NDA for any disputes. The chosen jurisdiction will have a impact on how the NDA is interpreted and enforced. |

Common challenges businesses face when reviewing NDAs

While NDAs are designed to be straightforward, reviewing them can present several challenges:

- Ambiguity in terms. Sometimes, the language used in an NDA can be vague or overly broad, leading to misunderstandings about what is and isn’t covered by the agreement.

- Overly restrictive clauses. Some NDAs may include overly restrictive terms that could limit your ability to conduct business, e.g., an NDA with a confidentiality obligation that lasts indefinitely.

- Lack of specificity. If the NDA doesn’t clearly, transparently define what constitutes confidential information or the obligations of the receiving party, it could leave your company vulnerable.

- Jurisdictional issues. If the NDA is governed by laws in a jurisdiction unfamiliar to your legal team, it might complicate enforcement, causing unfavorable outcomes in case of a dispute.

How to review an NDA – NDA review checklist

The goal of an NDA is to protect your company’s interests without exposing you to unnecessary risk. And having a structured approach, like an NDA review checklist, can make all the difference in terms of avoiding overlooking details and guaranteeing that the overall agreement fulfills its intended purpose.

Step 1: Identify the parties involved. Start by confirming that the NDA accurately identifies all parties. Individual names spelled correctly and that the legal entities are properly represented. If the agreement involves multiple parties, be clear on who’s disclosing and who’s receiving the information.

Step 2: Review the definition of confidential information. The definition of ‘confidential information’ is the heart of any non-disclosure agreement. It should be specific enough to protect the intended information but broad enough to cover all relevant aspects. . Look for any ambiguities that could lead to misinterpretations. For example, does the NDA clearly outline what’s considered confidential?

Step 3: Examine the confidentiality obligations. This section outlines the responsibilities of the receiving party. Verify that the obligations are clear. Check if the NDA specifies how the confidential information should be handled, who can access it, and what measures should be taken to protect it.

Step 4: Assess the term and termination clauses. Determine how long the confidentiality obligations will last. Some NDAs may impose indefinite obligations, which could be overly burdensome. Typically, non-disclosure agreements have a fixed term, such as one to five years, but the reality is that this can vary depending on the nature of both the information and the business relationship.

Step 5: Check for dispute resolution provisions. Dispute resolution clauses and terms are essential for managing potential conflicts that may arise from the non-disclosure agreement (NDA). Watch for clauses that specify how disputes will be handled, whether through arbitration, mediation or litigation.

Step 6: Scrutinize the indemnity clause. An indemnity clause in an NDA provides protection by guaranteeing that one party compensates the other if there’s a breach of the agreement. This is a decisive area to review carefully, as it can have tremendous financial implications. Make sure the indemnity provisions are fair and balanced, without placing an unreasonable burden on your company.

Step 7: Evaluate the exclusions from confidentiality. Not all information shared during a business relationship is considered confidential. The NDA should clearly outline exclusions, such as information that is already public, independently developed by the receiving party, or legally required to be disclosed.

Step 8: Review governing law and jurisdiction. Finally, check the governing law and jurisdiction clauses to ensure they are favorable to your company. These clauses determine which laws will apply to the non-disclosure agreement (NDA) and where any legal disputes will be resolved. If the jurisdiction is unfamiliar or inconvenient, it could complicate enforcement or legal proceedings down the line.

Extra consideration for any NDA review

As former general counsel and prosecutor Rob Chesnut notes on a piece for Bloomberg Law in March 2024, the overuse of NDAs can also lead to serial misbehavior and embarrassing public reveals. Chesnut advises companies to consider when to require NDAs to avoid these downsides, highlighting the importance of not only what’s included in an NDA but also when it’s appropriate to use one.

You may be interested in How to Review a Master Service Agreement (MSA)?

AI contract review software for NDA review

As the complexity and volume of contracts continue to grow, many businesses are turning to AI tools to streamline their NDA review processes. These tools are transforming how contracts are managed.

Speed – Accelerating the review process

One of the most immediate benefits of using AI in NDA review is the speed at which these tools can operate. Traditional contract reviews can be time-consuming, often requiring multiple rounds of scrutiny by legal teams. AI-driven tools, however, can process and analyze contracts in a fraction of the time.

Accuracy – Reducing human error

While human reviewers can miss subtle inconsistencies or make errors due to fatigue or oversight, AI contract review software is made to analyze contracts with precision. These trained technology recognizes specific legal language and flag potential issues that might otherwise go unnoticed.

Cost-efficiency – Saving on legal costs

Many fast-growing startups and SMEs may not always have extensive legal resources. AI tools help reduce the overall cost of NDA by automating much of the review process. Doing so cuts down on the hours required by legal teams and minimizes the need for expensive external legal costs.

Building a strong foundation with AI NDA reviews

A thorough NDA review protects your business’s sensitive information and maintaining strong, reliable partnerships. Integrating AI contract review software into your workflow can take your NDA reviews to the next level. AIn enhance the speed and accuracy of your reviews while also reducing costs—a advantage for businesses of all sizes, especially startups and SMEs with limited legal resources.

When you adopt astructured approach to how to review an NDA (non-disclosure agreement) with one that combines human expertise with advanced AI tools, it can help you avoid common pitfalls so your agreements are both comprehensive and enforceable. In doing so, you’ll be better equipped to protect your company’s interests, reduce risks, and foster successful, long-lasting partnerships.

By entering your email, you agree to our Terms & Conditions and Privacy Policy.